Around November each year, open enrollment for health insurance begins. Access to affordable, quality health insurance is important for everyone, especially those with chronic illnesses such as bleeding or auto-immune disorders. If you or someone you love is living with a chronic disorder, now is the time to act to ensure you have the coverage you need to manage your condition. Open enrollment allows you to evaluate your coverage and see if it matches your needs. This time period doesn’t last long, so it’s essential to look into it as soon as possible. Learn more about open enrollment for bleeding disorders.

How Long Does It Last?

Open enrollment lasts for several weeks, usually from around November to January in some instances. During this time frame, health insurance companies are required to allow new applicants to request coverage and participation in their plans. Since open enrollment only lasts a few weeks, try to take the time to know your options and look into the changes you need to have the best quality of life.

Why Open Enrollment Can Help You

If you or someone you love has a bleeding disorder and is looking for better healthcare coverage, open enrollment is the perfect time to research your options. Many individuals qualify for health insurance through their employer or can be covered under a family member’s plan. You can ask your employer about open enrollment and look into new or existing plan options. Others may have access to care through Medicare or the Affordable Care Act (ACA) marketplace. Open enrollment is the perfect time to look into potential plan changes if your coverage is too expensive or inadequate for your needs. Learn

Enroll in a New Plan

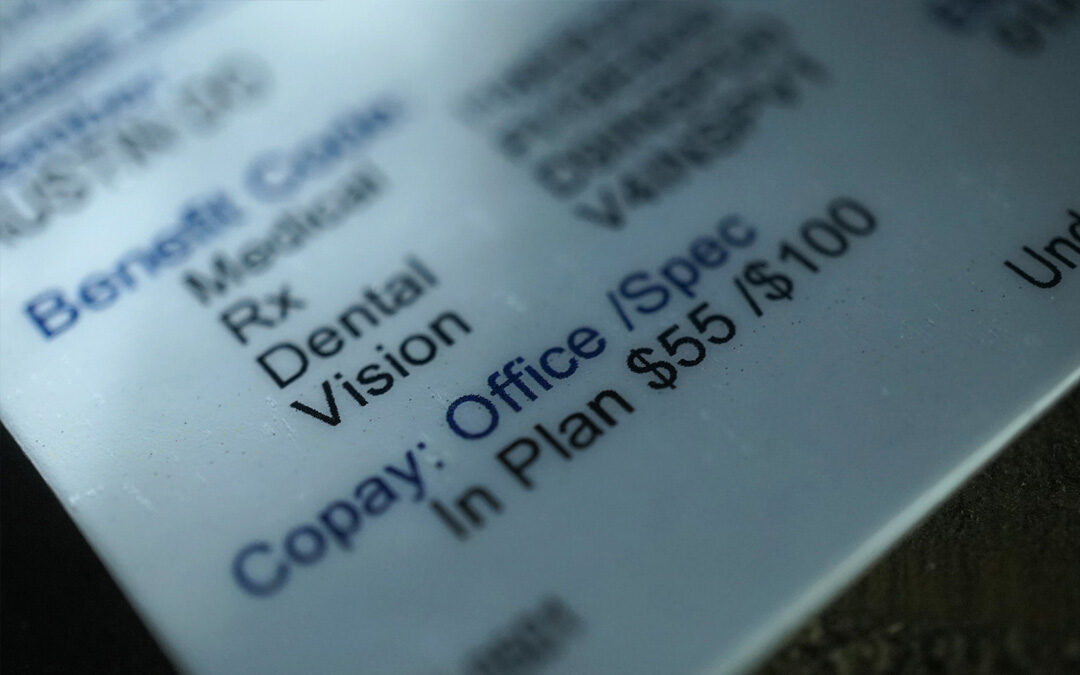

Adequate and affordable coverage is vital for people with bleeding disorders and other chronic conditions. Lack of healthcare can prove deadly, yet one should be able to afford the medications, visits, and other things as they arise. If your health insurance plan does not provide adequate coverage for these concerns, it’s time to shop around. Here are some other things to look for and keep in mind while you search for your options:

- Monthly premium costs

- High or low-deductible plan

- Cost of copays at routine visits

- Medication coverage

- Out-of-pocket costs

- Out-of-network benefits (access to your specialty pharmacy and treatment team)

- Copay accumulator adjustors

Changes Outside of Open Enrollment

Now is the time to look into changes to your health insurance plan if you need to do so. However, things do happen, and you may be able to make changes outside of the open enrollment time period due to a qualifying event. Several life events can count as a qualifying event but check with your health insurance provider if you have questions on if your circumstance is eligible to make changes to your plan. Here are some examples of qualifying events:

- Marriage

- New baby

- Employment changes

- Relocation

- Turning 65

- Death of current plan subscriber

If these events describe your situation and open enrollment has passed, reach out to your healthcare insurance provider to learn more about your options.

Questions about Open Enrollment for Bleeding Disorders? Contact Mylyfe Pharmacy Services.

If you have a bleeding disorder or other chronic health condition, you know how important it is to have reliable, affordable, and accurate healthcare coverage. Open enrollment is the perfect time to look into other options if you are unhappy with your current healthcare insurance plan. Contact Mylyfe at hello@mylyfe.health with any questions as you research your options.

Personalized Care,

Professional Excellence

Improving Your Quality of Life Is Our Mission